Over the past few years, data science has proven to be the best option for most fintech companies. Yet, you might not understand which technologies in the field influence fintech. The following are a few insights into the leading data science technologies that will significantly transform the world of fintech.

Augmented Reality and Virtual Reality

AR and VR technologies are taking over the data science and fintech worlds. These technologies aim at enhancing the interaction between machines and humans. You can rely on them to automate data insights, ensuring that machine learning and natural language processing become more seamless in the long run.

AR and VR will often help analyze patterns and generate shareable, intelligent data. These are critical elements of fintech. Unless you have enough actionable data at your disposal, making informed decisions becomes significantly challenging.

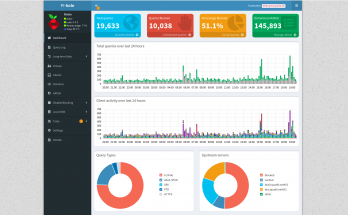

Cloud Services

While cloud services are not new, they enjoy surging popularity today. You could attribute this to the increased number of benefits, from convenience and flexibility to unmatched data privacy and management. Today, data science focuses on the proper storage and management of information. This move ensures that you access all the critical data you need on time.

Notably, fintech depends on excellent cloud services. On the other hand, data science provides the algorithms to ensure that cloud services work better. In turn, fintech companies enjoy better access to data, including remotely. According to Cane Bay Partners, cloud services are essential when dealing with large data sets.

Internet of Things

Today, everyone talks about the importance of IoT in ensuring that businesses thrive. Ideally, IoT entails devices and equipment with a unique IP address alongside an internet connection. Seamless connection happens with the help of this internet access. In most cases, you’ll expect the IoT devices to have smart sensors and meters to facilitate interaction.

This data science technology has a significant impact on fintech. Companies in this field rely on the Internet of Things to facilitate predictive analytics. Predictive analytics is vital in any fintech setup, cushioning the company against significant losses in the long run.

Quantum Computing and Technology

Suppose you have complex calculations to perform, particularly from large sets of data. In this case, you’ll need reliable technology to help you do it within a considerably short time. The best option to turn to in this case will be quantum computing—a data science technology in its initial stages.

You should note that this technology stores large data sets in quantum bits, ensuring that the computation takes a shorter time. Fintech companies will use this technology to get accurate information about various aspects, including consumer behavior. Yet, everyone at Cane Bay Partners would say that without data science algorithms, quantum technology would not be applicable in fintech.

Automated Machine Learning

Machine learning has proven an excellent learning tool. Most companies today use it alongside chatbots and RPA (Robotic Process Automation). These chatbots will comfortably understand a client and provide premium-quality solutions, improving customer experience in the long run. In turn, fintech companies will use this technology to help improve customer experience in the long run.

Automated machine learning is a technology in the data science field. It uses various elements of data science, including regression, supervised clustering, and data management. All these elements ensure that automated machine learning works seamlessly. However, you must use the services of a consultant in the technology field when embracing this innovation. It will help avoid issues.

To sum it all, various technologies in the data science world have proven essential in fintech. These technologies have helped transform how the industry operates, enhancing seamlessness and productivity in the long run.